The Ultimate Guide To Retirement Planning

Introduction

Retirement planning is a critical component of financial wellness, yet many people find it daunting. Understanding how to prepare effectively can secure a comfortable future. This guide delves into strategic planning to ensure a stress-free retirement.

Advertisement

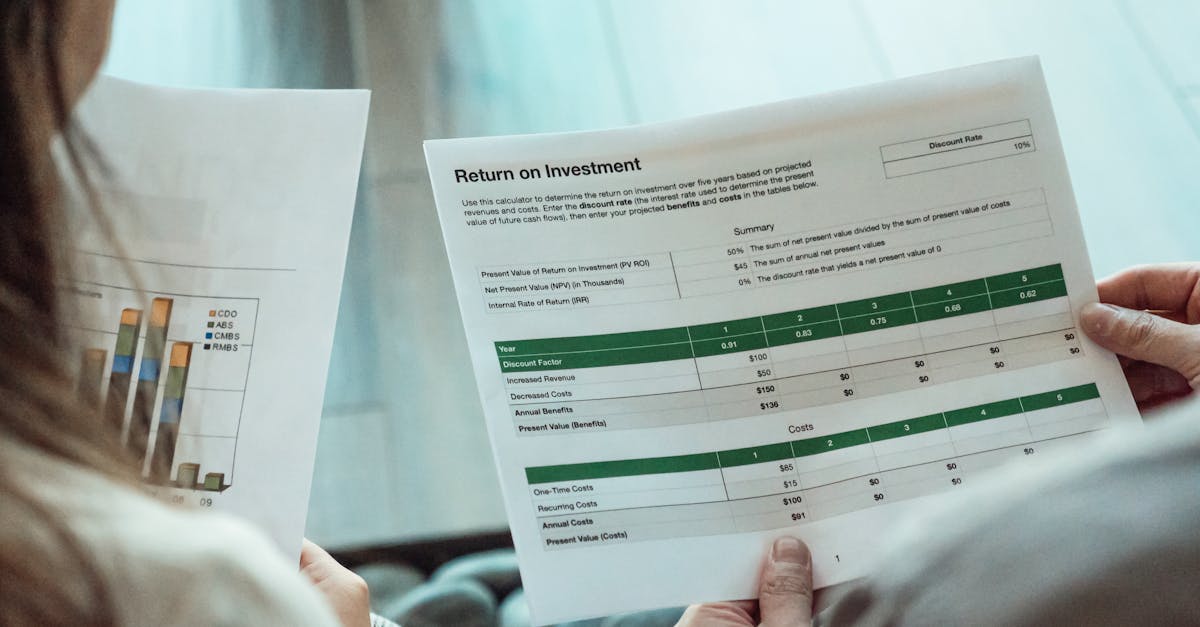

Assessing Your Current Financial Situation

Begin your retirement planning journey by analysing your current financial state. This includes assessing your income, expenses, savings, and investments. An understanding of your net worth will help determine how much you need to save for a comfortable retirement.

Advertisement

Setting Retirement Goals

Clear goals define the path toward a successful retirement. Consider lifestyle changes, potential travel plans, and desired retirement age. Establish both short-term and long-term goals to guide your financial strategy effectively.

Advertisement

Understanding Retirement Accounts

There are various retirement accounts available, each with unique benefits. Familiarize yourself with options like 401(k)s, IRAs, and Roth IRAs. Contributing regularly and understanding the tax implications of each account is vital to your retirement plan.

Advertisement

Developing a Savings Plan

An effective savings plan is essential for retirement security. Aim to save at least 15% of your income annually. Automation can help ensure consistency, and periodically review your contributions to adjust for changes in income or expenses.

Advertisement

Investing Wisely

Investing plays a pivotal role in growing your retirement savings. Diversify your investments to balance risks and returns, considering both stocks and bonds. Assess your risk tolerance and adjust your portfolio as you near retirement.

Advertisement

Creating a Budget in Retirement

Budgeting doesn’t end on retirement day. Project your retirement expenses, including healthcare, travel, and leisure. Managing your budget helps avoid overspending and ensures your retirement funds last throughout your life.

Advertisement

Protecting Your Retirement Income

Safeguarding your retirement income from inflation and unexpected costs is crucial. Consider insurance options, such as life and health insurance, and regularly review your financial strategies to adapt to changing needs.

Advertisement

Navigating Social Security Benefits

Understanding Social Security benefits is key to maximizing your retirement income. Determine your eligibility and the best time to start claiming benefits. Delaying benefits until full retirement age can significantly increase your payout.

Advertisement

Conclusion

In conclusion, effective retirement planning involves assessing finances, setting goals, and understanding available resources. Building a substantial nest egg is achievable with strategic savings and wise investment choices. By planning today, you can enjoy a fulfilling retirement tomorrow.

Advertisement